Only a Handful of Properties in the Roseburg High-Risk Zone are Insured Against Flooding

ROSEBURG, Ore. — Only 173 of the 1,405 buildings in the Roseburg Special Floodplain Hazard Area are insured for flood damage.

This has sparked a call from the Roseburg Community Development Department and the Federal Emergency Management Agency (FEMA) for all property owners in or close to flood zones to obtain insurance to safeguard their properties this spring.

Deer Creek, South Umpqua River, and Newton Creek are the Danger Zones

Only 12.3% of the 1,405 buildings located in Roseburg’s high- risk zone is insured against flooding. The properties include residential, commercial, industrial, institutional, government, and public park spaces located along Deer Creek, the South Umpqua River, and Newton Creek.

Although Roseburg has not experienced major flooding for almost 30 years, it is inevitable that creeks and rivers will flood again, says Roseburg Senior City Planner and Floodplain Administrator, Mark Moffett. He says that the more property owners who have flood insurance will help Roseburg to recover and rebuild quickly in the event of a flood.

Property owners with government-backed mortgages are required to insure their buildings. Most homeowners and or non-residential building insurance do not include protection for flooding.

Insured Properties Reap Financial Benefits

Roseburg Community Development Department Director, Stuart Cowie, emphasizes the importance of assisting private developers to adhere to FEMA floodplain standards. Cowie says that this ensures the City of Roseburg maintains compliance with the National Flood Insurance Program, resulting in financial benefits for residents with flood insurance who will be offered reduced insurance premiums.

Property owners living within city limits qualify for a 15% discount on full-risk National Flood Insurance Program policies. Roseburg is one of 19 Oregon cities that qualify for the discount because of its Class 7 FEMA Community Rating System. Roseburg has earned this discount for its city dwellers by continuously maintaining public information campaigns, flood damage reduction, mapping, warning, and responding.

Use the Floodplain Information Map

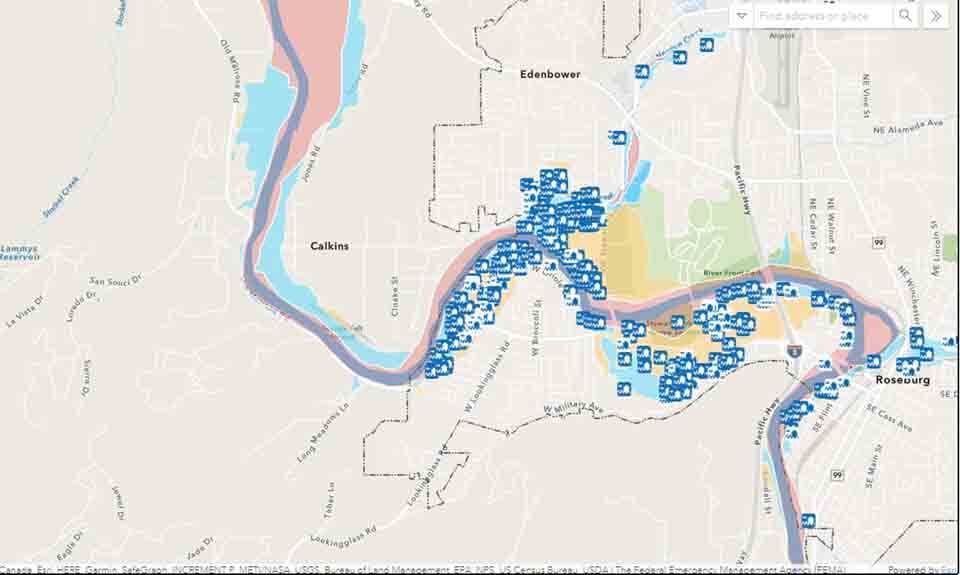

To determine where a property lies in relation to flood zones property owners, homebuyers, realtors, renters, and insurance agents can refer to the Community Development Department’s interactive Floodplain Information Map.

Property owners are reminded by FEMA that flooding is not restricted to high-risk areas, and can happen in any location where rain or snow falls. In fact, 40% of flood insurance claims under the National Flood Insurance Program involve properties in low- to moderate-risk areas.

FEMA says drought and wildfires also increase flood risks, pointing out that only one inch of floodwater can cause $25,000 in damage. Property owners are also reminded that federal disaster financial assistance is only granted if a disaster is declared, whereas insurance will protect the policyholder if that did not happen.

When flooding is imminent, policyholders of National Flood Insurance are eligible for up to $1,000 to buy emergency supplies such as sandbags, tarps, and water pumps. The insurance also covers the cost of labor, storage and moving expenses.

Residents who have questions about development or residential and commercial improvements within the floodplain, should contact the Roseburg Community Development Department at 541-492-6750, or [email protected]. Contact insurance providers with questions about flood insurance.